Calculating the Present and Future Value

Calculating the Present and Future Value

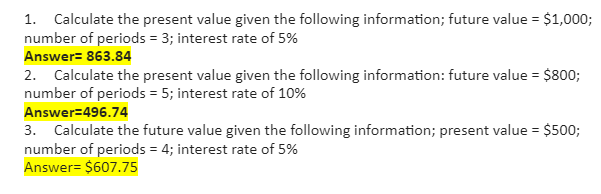

- Calculate the present value given the following information; future value = $1,000; number of periods = 3; interest rate of 5%

- Calculate the present value given the following information: future value = $800; number of periods = 5; interest rate of 10%

- Calculate the future value given the following information; present value = $500; number of periods = 4; interest rate of 5%

- Calculate the present value given the following information; present value = $2,500; number of periods = 2; interest rate of 15%

- Calculate the present value of an annuity due given the following information: number of periods = 3, interest rate of 6% and a payment of $200

- Calculate the net present value with a required return of 10%, an initial investment of $30,000, and 10 years of payments of $6,000 each

- Calculate the net present value with a required return of 8%, an initial investment of $45,000, and cash flows of $12,000, $20,000, $10,000, and $6,000 for years 1 through 4 respectively.

- Given the following information, a required return of 8%, an initial investment of $45,000, and cash flows of $12,000, $20,000, $10,000, and $6,000 for years 1 through 4 respectively, should the investment be done?

- Calculate the net present value with a required return of 5%, an initial investment of $45,000, and cash flows of $9,000, $8,000, $15,000, and $20,000 for years 1 through 4 respectively.

- Given the following information, with a required return of 5%, an initial investment of $45,000 and cash flows of $9,000, $8,000, $15,000, and $20,000 for years 1 through 4 respectively, should the investment be done?

- Calculate the break-even given the following information (number of units); sales per unit of $25, variable costs of $13, fixed costs of $5,000. Remember, you cannot have partial units, so you will need to round up id the answer is a decimal.

- Calculate the break-even given the following information (amount in dollars); sales per unit of $40, variable costs of $15, fixed costs of $15,000, and a desired profit of $20,000. Remember, you cannot have partial units, so you will need to round up if the answer is a decimal.

- Calculate the differences between the sales and the operation income for each of the given years given the following information: sales of $25,000; variable costs of $13,000; and operating income of $7,000 for year one, and sales of $40,000; variable costs of $15,000; and operating income of $16,000 for year 2. (Answer expressed as a percentage; rounded to two decimal places)

Answer Preview-Calculating the Present and Future Value

$8.00