Balance Sheet and Bad Debts Analysis

Balance Sheet and Bad Debts Analysis

Critical Thinking: Balance Sheet (50 points)

Lander Inc. had the following balance sheet at December 31, 2008:

| LANDER, INC. Balance Sheet December 31, 2008 |

||||

| Cash | $45,300 | Accounts payable | $33,800 | |

| Accounts receivable | $18,900 | Bonds payable | $35,000 | |

| Investments | $25,000 | Common stock | $190,000 | |

| Plant assets (net) | $78,000 | Retained earnings | $18,400 | |

| Land | $110,000 | |||

| Total Assets | $277,200 | Total Liabilities & Equity | $277,200 | |

During 2009 the following occurred.

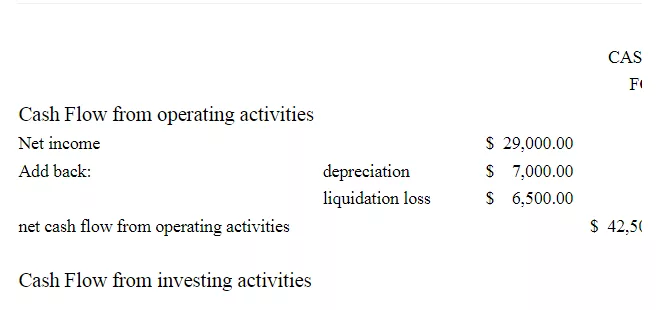

- Lander liquidated its available-for-sale investment portfolio at a loss of $6,500.

- A tract of land was purchased for $31,000.

- An additional $20,000 in common stock was issued at par.

- Dividends totaling $5,000 were declared and paid to stockholders.

- Net income for 2009 was $29,000, including $7,000 in depreciation expense.

- Land was purchased through the issuance of $25,000 in additional bonds.

- At December 31, 009, Cash was $72,650, Accounts Receivable was $35,250, and Accounts Payable was $32,500.

- Prepare a statement of cash flows for the year 2009 for Lander.

- Prepare the balance sheet as it would appear at December 31, 2009.

Week 4

Critical Thinking: Bad Debts (50 points)

Chatter Corporation operates in an industry that has a high rate of bad debts. Before any year-end adjustments, the balance in Chatter’s Accounts Receivable account was $389,000 and the Allowance for Doubtful Accounts had a debit balance of $5,000. The year-end balance reported in the balance sheet for the Allowance for Doubtful Accounts will be based on the aging schedule shown below:

| Days Account Outstanding | Amount | Probability of Collection |

| Less than 16 days | $293,000 | .97 |

| Between 16 and 30 days | $102,000 | .89 |

| Between 31 and 45 days | $ 70,000 | .83 |

| Between 46 and 60 days | $ 55,000 | .76 |

| Between 61 and 75 days | $ 28,000 | .60 |

| Over 75 days | $ 8,000 | .30 |

- What is the appropriate balance for the Allowance for Doubtful Accounts at year-end?

- Show how accounts receivable would be presented on the balance sheet.

- What is the dollar effect of the year-end bad debt adjustment on the before-tax income?

Answer Preview-Balance Sheet and Bad Debts Analysis

$8.00