Capital Budgeting Practice Problems

Case Assignment

This case has two separate parts.

Part I: Capital Budgeting Practice Problems

a. Consider the project with the following expected cash flows:

| Year | Cash flow |

| 0 | -$400,000 |

| 1 | $100,000 |

| 2 | $120,000 |

| 3 | $850,000 |

- If the discount rate is 0%, what is the project’s net present value?

- If the discount rate is 2%, what is the project’s net present value?

- If the discount rate is 6%, what is the project’s net present value?

- If the discount rate is 11%, what is the project’s net present value?

- With a cost of capital of 5%, what is this project’s modified internal rate of return?

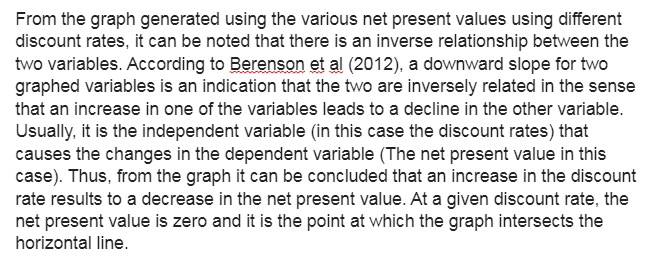

Now draw (for yourself) a chart where the discount rate is on the horizontal axis (the “x” axis) and the net present value on the vertical axis (the Y axis). Plot the net present value of the project as a function of the discount rate by dots for the four discount rates. Connect the four points using a free hand ‘smooth’ curve. The curve intersects the horizontal line at a particular discount rate. What is this discount rate at which the graph intersects the horizontal axis?

[ Look at the graph you draw and write a short paragraph stating what the graph ‘shows’]

b. Consider a project with the expected cash flows:

| Year | Cash flow |

| 0 | -$815,000 |

| 1 | $141,000 |

| 2 | $320,000 |

| 3 | $440,000 |

- What is this project’s internal rate of return?

- If the discount rate is 1%, what is this project’s net present value?

- If the discount rate is 4%, what is this project’s net present value?

- If the discount rate is 10%, what is this project’s net present value?

- If the discount rate is 18%, what is this project’s net present value?

Now draw (for yourself) a chart where the discount rate is on the horizontal axis (the “x” axis) and the net present value on the vertical axis (the Y axis). Plot the net present value of the project as a function of the discount rate by dots for the four discount rates. Connect the four points using a free hand ‘smooth’ curve. The curve intersects the horizontal line at a particular discount rate. What is this discount rate at which the graph intersects the horizontal axis?

[ Observe the graph and write a short paragraph stating what the graph ‘shows’]

c. Read the background materials. Then write a one-to-two page paper answering the following question:

Which method do you think is the better one for making capital budgeting decisions – IRR or NPV?

Part 2: Equity and Debt

Read the article below available in ProQuest:

American Superconductor switch ; Westboro company plans to raise money through a stock offering, Andi Esposito. Telegram & Gazette. Worcester, Mass.: Aug 26, 2003. pg. E.1

Abstract (Article Summary)

“AMSC’s management and board of directors believe the decision to forgo a secured debt financing and to adopt an equity financing strategy under current market conditions is in the best interests of our shareholders,” said Gregory J. Yurek, chief executive officer of AMSC. The 265-employee company has operations in Westboro and Devens and in Wisconsin.

Finally, the Northeast blackout “shined a lot of light on the problems we have been talking about as a company for three to four years,” Mr. Yurek said. AMSC products, such as a system installed this year in the aging Connecticut grid and high temperature superconductor power cables and other devices bought by China for its grid, are designed to improve the cost, efficiency and reliability of systems that generate, deliver and use electric power. “We are a company with products out there solving problems today,” he said.

After reading the background materials and doing your research, apply what you learned from the background materials and write a two to three page paper answering the following questions:

What are the advantages and disadvantages for AMSCto forgo their debt financing and take on equity financing? Do you agree with their decision? How can a company’s cost of equity be determined? Is there a tax deduction from the use of debt financing? Please explain.

Explain your answers thoroughly. Be sure to support your opinions on these assignment questions with references to the background materials or to other articles in your paper.

Answer Preview-Capital Budgeting Practice Problems